Follow the Money Edition 9: Monday, February 10th, 2025

I think I fell asleep and woke up in 2020

Deep Insight: SPACs? Did I fall asleep and wake up in late 2020?

Rithm Acquisition, a SPAC targeting financial services and real estate, filed for a $200m IPO. This is Michael Nierengberg. For the past two decades Rithm has made a name for themselves in what is today an extremely coveted niche within real estate: residential credit. People always need a place to live, that makes residential attractive. In periods of contraction and high interest rates, credit platforms outperform equity as investors fly to safety. Why invest in equity and make risky 15% returns when you can invest in credit and make risk-free 12% returns? That’s the calculation a lot of capital allocators start to make in periods of high interest rates.

But with interest rates now declining, it’s possible that Rithm sees an opportunity to capitalize on the other side of the business - expanding valuations. They plan to take an investment or real estate company public via their SPAC over the next few months.

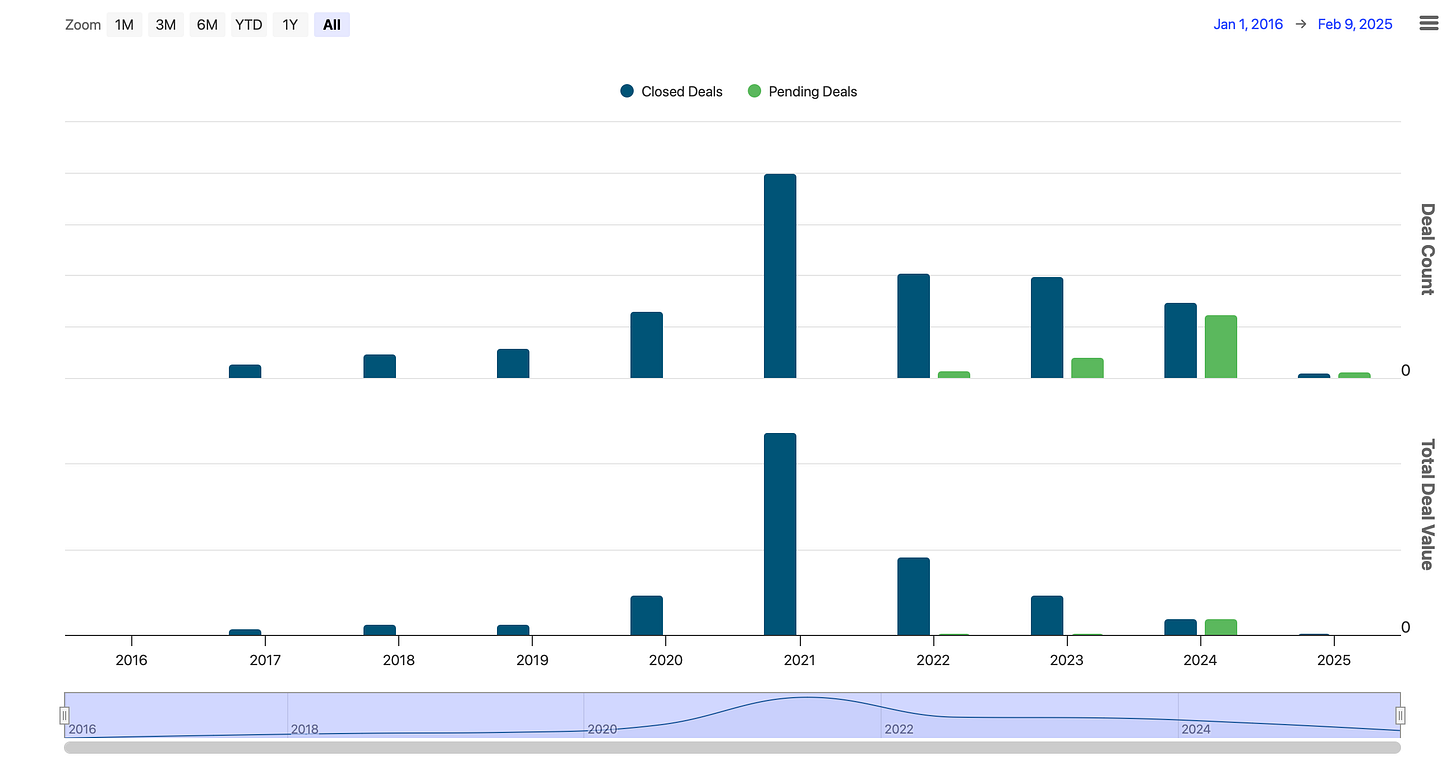

There was another SPAC filed last week called “Real Asset Acquisition”. Less information on that one and the sponsor’s background is not in real estate, but just the name itself is interesting. I feel like I haven’t seen a slew of SPACs IPO since 2020, and I feel right, take a look at the chart below. The interesting thing is, with closed SPACs having peaked in 2021 and ruthlessly chewed through retail capital in the public markets shortly thereafter, it would appear that the least bashful of the sponsors are back with egg on their face to sponsor more. SPACs started ticking back up in late 2024 and that trend continues in early 2025.

Having said that, and humor aside, it seriously does feel like we’re at the beginning of a new cycle. How about that.

VC Funding Rounds

75F, a Minneapolis-based company commercial HVAC automation company, raised $45m in Series B funding. Accurant International led, and was joined by Carrier Global, Climate Investment, Breakthrough Energy Ventures, Next47, and Wind Ventures.

BRKZ, a Saudi construction tech startup, raised $8m in Series A extension funding (including $1m of debt) from insiders Aramco, BECO Capital, Better Tomorrow Ventures, Class 5 Global, Fluent Ventures, Knollwood Investment Advisory, MISY Ventures, RZM Investment, and 9900 Capital.

Quick Insight: Dubai has 3 times as many supertalls as New York City, and they started building about 100 years after New York did… and despite being sold to the west as a unique entity they are nothing more than an outpost of Saudi Arabia, where MBS has plans to have Riyadh and Jeddah follow suit

Centerseat, an Austin, Texas-based physical security compliance startup, raised $2.7m in seed funding led by Silverton Partners.

Comstruct, a German construction procurement platform, raised €12.5m. GV and 20VC co-led, and were joined by insiders Booom and Puzzle Ventures.

Pendulum, a supply chain planning startup, raised $11m in VC funding and $11m in non-diluted R&D funding from Lowercarbon Capital, Cross Border Impact Ventures, Decisive Point, Collab Fund, and Blaise Agüera y Arcas.

Monograph, an SF-based architecture project management platform, raised $20m in Series B extension funding led by Base10 Partners.

GenLogs, an Arlington, Va.-based freight intelligence startup, raised $14.6m in Series A funding co-led by Venrock and HOF Capital.

Protex AI, an Irish developer of workplace safety tech, raised $36m in Series B funding. Hedosophia led, and was joined by Salesforce Ventures.

Keep reading with a 7-day free trial

Subscribe to Mark to Market to keep reading this post and get 7 days of free access to the full post archives.