Follow the Money Edition 3: Sunday, August 25th, 2024

Fortera Global, Silicon Valley's idea of Hollywood's idea of a Silicon Valley company

Deep Insight: Fortera Global, promising net-zero concrete, has a big valuation to grow into

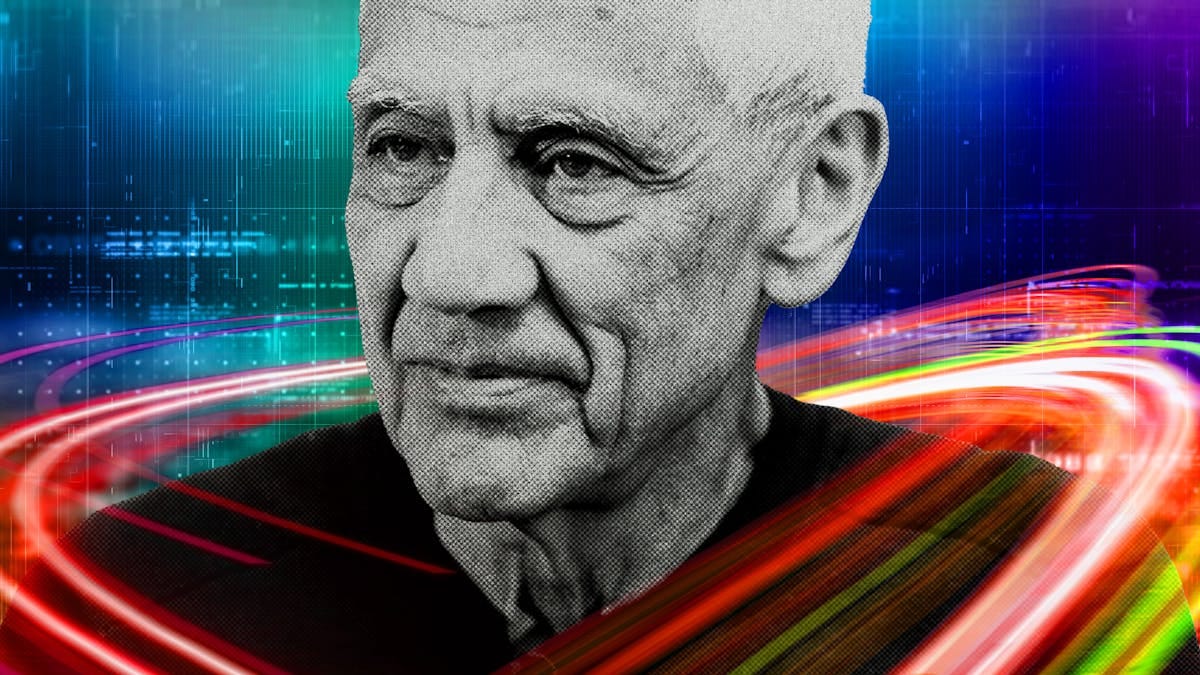

Fortera, the latest darling of the climate-tech scene, has raised an impressive $85M Series C round, pushing its valuation well into the 9-figure range. Vinod Khosla’s Khosla Ventures, and a cohort of similar firms from Silicon Valley’s highest circles have backed the company. Khosla’s recent media appearances lambasting the “drill baby drill” rhetoric of a growing MAGA resistance amongst his neighbors on Sand Hill Drive provide credibility to his position; and equip him perhaps with the proverbial staff to guide forward Fortera’s potential to revolutionize the cement industry. But underneath the fanfare, the challenges are monumental.

The cement industry is notorious for being slow to adopt change, and for good reason. Cement production is a capital-intensive, highly regulated process where margins are razor-thin. Fortera’s ReCarb technology promises to reduce carbon emissions while maintaining cost parity with traditional methods. But when we get down to brass tacks: the decision-makers, the capital allocators at construction firms and real estate developers, are bound by stringent budgets. Sustainability, although a priority, regularly plays second fiddle to time and cost constraints. Fortera’s technology, while promising, needs to fit neatly within these financial constraints; as well as overcome supply chain and regulatory issues. Construction-site decisions are often not driven by which cement provider has the best product, but by which one has the nearest mixing plant. In these infrastructure-constrained, monopolistic markets, venture-level growth and scale can be difficult to reach.

Achieving revenue to justify a nine-figure valuation is tall ask in any industry. Within construction, where projects are specified years in advance and budgets are already tight, convincing the industry to adopt new technology often requires more than just a better product—it needs to be a product that doesn’t disrupt the existing workflow or blow the budget. Fortera’s executive team, composed of former-CEO PhDs and advised by silicon valley’s heavyweights, certainly has the pedigree on paper to execute. But steering a startup through structural mazes can require more than pure intellectual horsepower. Reid Hoffman, founder of LinkedIn and partner at Greylock recently explained as he was reflecting on a missed opportunity to invest in SpaceX: “If an industry has had decades of technological innovation that are not reflected in the market because the structure of the market locks in this anti-innovation oligarchy; it provides a massive opportunity to break the oligarchy and achieve a huge return. But it requires a team with a mentality that will take down the whole wall as they run through it.”

Khosla’s enthusiasm, coupled with an executive team that boasts both experience and academic prowess, paints a rosy picture. But as with many startups that reach astronomical valuations, there’s a fine line between ambition and hubris. Fortera’s journey from a promising startup to a market leader will be fraught with challenges that go beyond the laboratory and boardroom. It will require deft navigation of market forces, a keen understanding of industry politics, and sheer fortitute. A Hollywood casting director couldn’t find a more stereotypical company to include in a classic movie about tech geniuses in the bay, but only time will tell if Fortera’s dream of a low-carbon future will become reality or just another cautionary tale in the annals of venture capital.

VC Funding Rounds

Fortera, maker of low-carbon cement, raised $85M in Series C funding from firms like Khosla Ventures and Temasek.

Quick insight: Fortera is one of the better-capitalized companies in the “zero-carbon cement” revolution, which I covered extensively in Thesis Driven

Trunk Tools, a New York provider of automation solutions for construction documentation, raised $20M in Series A funding led by Redpoint.

Home Run Dugout, a baseball-focused eat-ertainment concept, raised $23M in Series A funding led by Lagniappe Capital Partners.

Quick insight: Baseball meets TopGolf. Similar concept and real estate footprint. Lots of overlap in the target consumer as well. Frankly surprised this didn’t happen sooner.

Optiml, an online platform for net-zero real estate investment and renovation, raised $4M led by BitStone Capital, and joined by Kompas VC, Innovation Endeavors, Planet A Ventures and others.

Apheros, a developer of cooling solutions for data centers, raised $1.9M led by Founderful.

Deep Fission, a developer of underground nuclear reactors, raised $4M led by 8VC.

Quick insight: This isn’t necessarily real estate, but it is built-world related, and it’s also just super cool. Despite it’s bad reputation, nuclear is one of the most sustainable and safest forms of energy as we move into the future.

Keep reading with a 7-day free trial

Subscribe to Mark to Market to keep reading this post and get 7 days of free access to the full post archives.